Generate Steady Passive Income Backed by Real Estate

APEX INFINITY FUND

Built for serious investors looking for stability and growth

10%

Fixed Returns

$25,000

Min Investment

18 month

Initial Lock-up

100%

Passive

No

Fees

For Accredited Investors Only

- Cash Flow from Distributions: Generate steady income through regular distributions, backed by tangible real estate assets.

- Stable Income & Long-Term Appreciation: Achieve consistent income with the potential for long-term capital growth and value appreciation.

- Inflation Hedging & Capital Preservation: Protect your investment against inflation while preserving capital in dynamic market conditions.

- Diversified Portfolio: Mitigate risk by investing in a broad range of assets, creating economies of scale for greater stability.

- Evergreen Structure & Professional Management: Benefit from a flexible, ongoing investment model with expert management handling all aspects of your portfolio.

Compounding Power That Rewards Long-Term Investors

Total Growth

- 100% of earnings are reinvested

- Maximize long-term wealth through compounding

- Ideal for investors focused on growth & deferring income

Growth & Income

- 50% of returns distributed every 6 months

- Remaining 50% continues compounding

- Balanced strategy for cash flow + portfolio growth

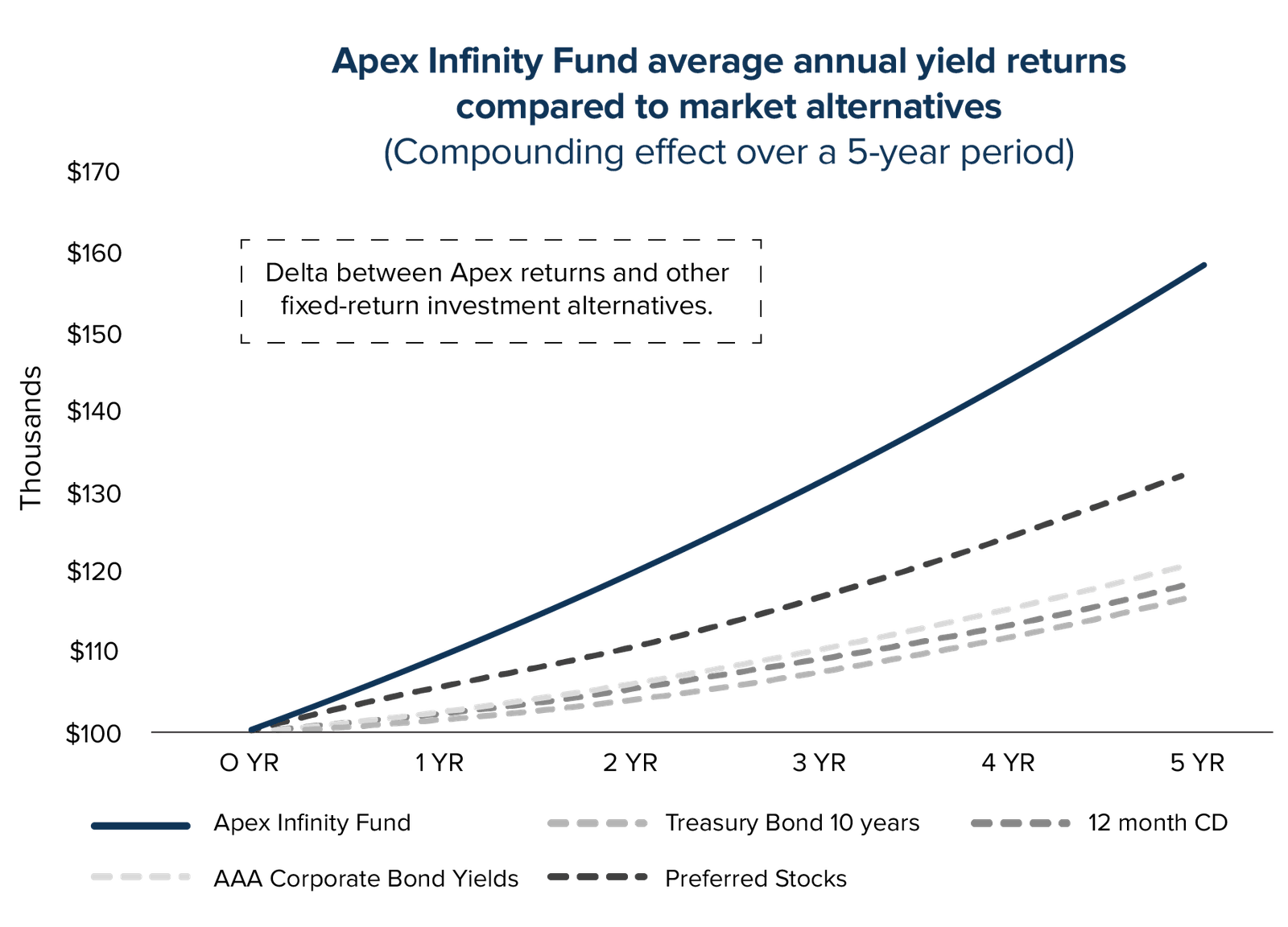

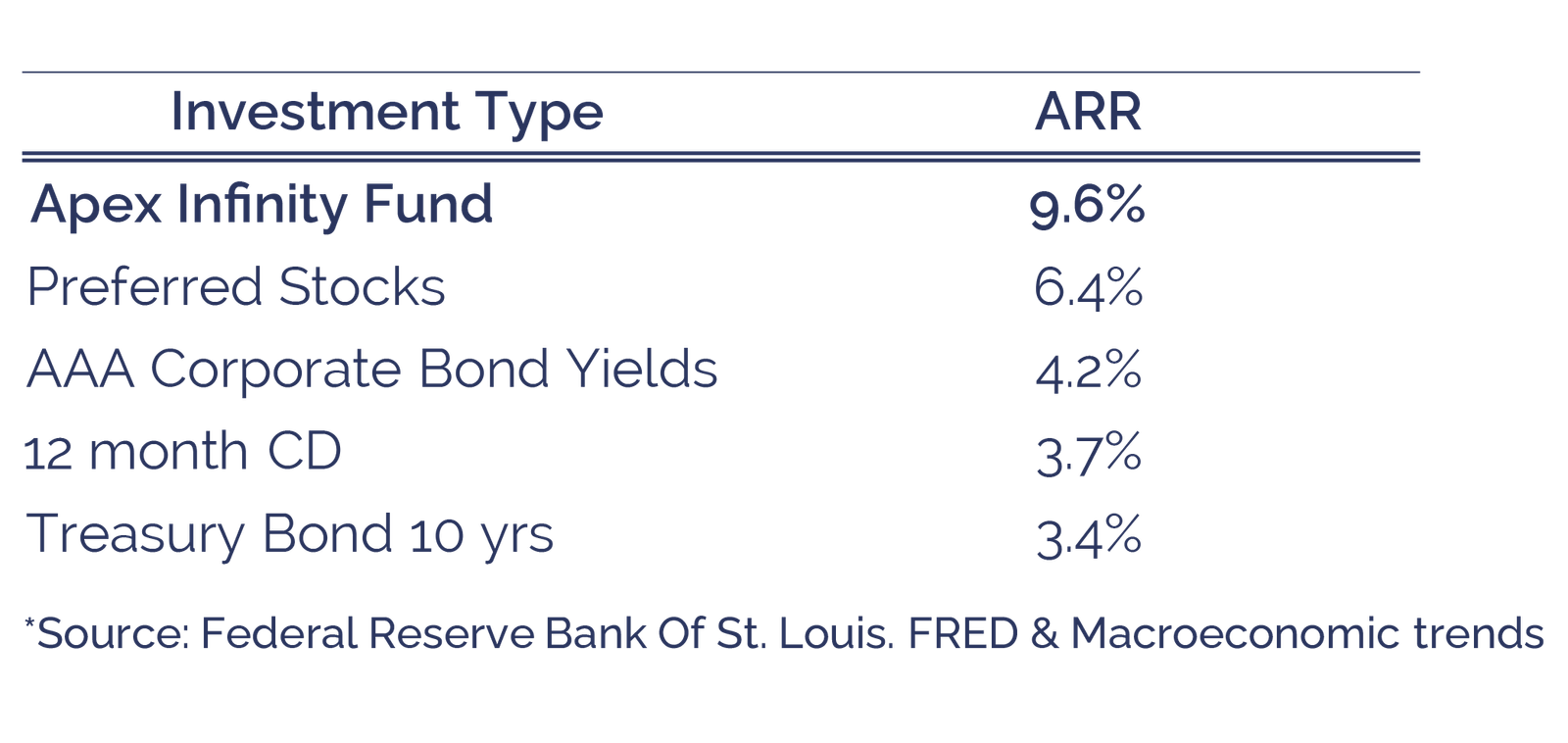

This Fund Is The Alternative to Stocks, Bonds & CDs You’ve Been Waiting For

Traditional paper yields have their limits

CDs, bonds, and preferred stocks may offer stability—but often at the cost of returns, liquidity, or control. Apex Infinity Fund is engineered to solve for those gaps, offering a more agile, real-asset-based alternative that’s structured for today’s investor: one who values reliability, transparency, and the ability to adapt.

Access, Liquidity & Discipline—All in One Fund

OUR INVESTMENT STRATEGY

Back your portfolio with brick-and-mortar investments built to generate steady returns

BTS (Build to Sell)

Multifamily

BTR (Build to Rent)

Choose the Return Strategy That Fits You Best

Total Growth

- 100% of earnings are reinvested

- Maximize long-term wealth through compounding

- Ideal for investors focused on growth & deferring income

Growth & Income

- 50% of returns distributed every 6 months

- Remaining 50% continues compounding

- Balanced strategy for cash flow + portfolio growth

Frequently Asked Questions

Apex Infinity Fund is a secured debt fund that offers investors fixed returns through a diversified portfolio of assets, including single-family homes for sale, single-family rentals, multifamily properties, hard money loan originations, among other applicable real estate strategies. The fund provides consistent and reliable returns, liquidity, and flexibility for investors.

In order to get started please click here.

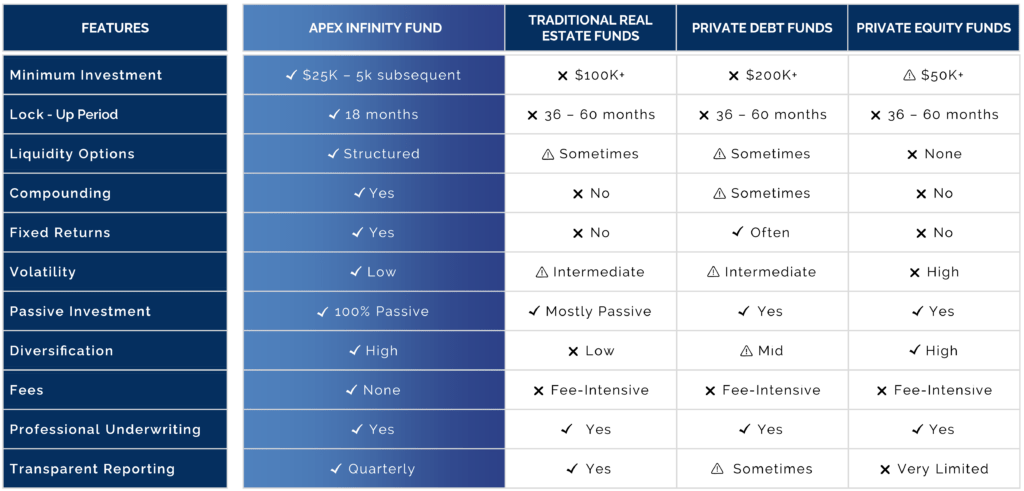

There are three different share classes, starting with a minimum investment of $25,000:

- Class A: $1.000.000+ – 10% return

- Class B: $700.000 to $999,999 – 9% return

- Class C: $400.000 to $699,999 – 8.5% return

- Class D: $100,000 to $399,999 – 8% return

- Class E: $25.000 to $99.999 – 7% return

Additionally, there are two distribution options:

- Maximum Growth (without dividend) – No distributions during the holding period, allowing the entire investment to obtain a higher Annual Rate of Return (ARR) over time.

- Income and Growth (with dividend) – Bi-yearly distributions as follows: 50% of the earned return distributed, the remaining 50% consistently compounds.

Interested in learning more? Contact us.

Our Investor Relations team will provide quarterly reports, and it will be always available to answer any questions regarding your investments or fund performance.

Follow us on our social media to stay up to date: LinkedIn, Instagram.

Investors benefit from enhanced flexibility and liquidity, as withdrawals require only a 6-month’ notice following the initial 18-month lock-up period.

Interested in learning more? Contact us!

Yes, fractional shares can be acquired. After the initial amount, subsequent contributions can be made anytime from $5,000 onwards.

Distributions are made bi-yearly, every February 28th and August 31st.

Apex’s managing partners have over 25 years of combined experience. Additionally, our team of 20+ professionals enhances our vertical integration and expertise.

Apex initially focused on SFR renovations, then expanded to multifamily value-add and SFR development. Today, we have successfully consolidated 500+ units, over $80 million in assets under management, and $20 million in successfully realized transactions.

Under SEC guidelines, Regulation D allows companies like Apex to raise capital under specific rules. Rule 506C allows capital to be raised from an unlimited number of accredited investors.

Learn more here.

Apex initially focused on SFR renovations, then expanded to multifamily value-add and SFR development. Today, we have successfully consolidated 500+ units, over $80 million in assets under management, and $20 million in successfully realized transactions.

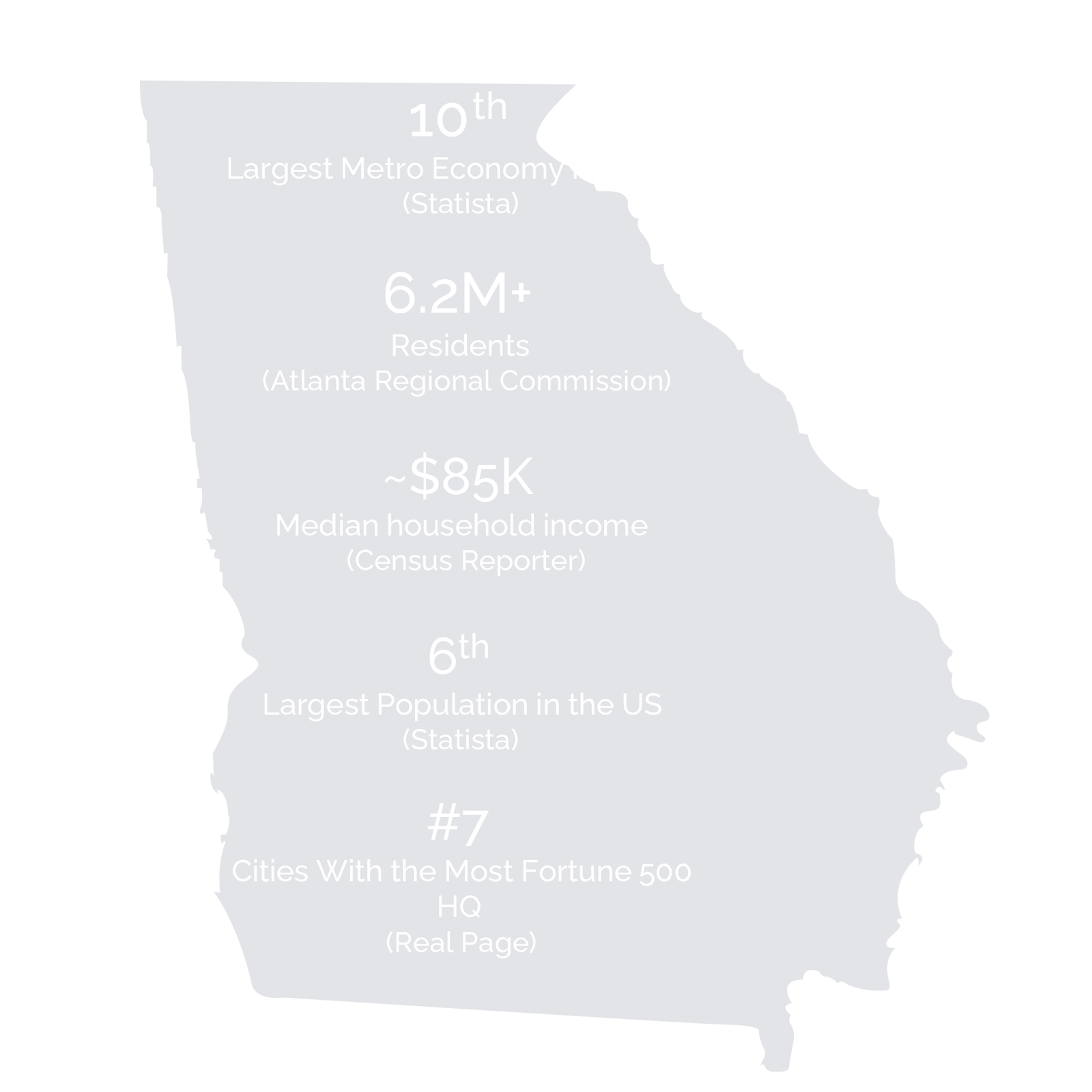

STRATEGIC MARKET FOCUS

Georgia checks every box for long-term

real estate performance.

Decades of Results. Delivered for Investors

Units

Equity Raised

AUM

Meet Our Managing Partners

Daniel Angel

Head of Finance Management

Daniel Gonzalez

Head of Acquisitions and Asset Management

This Property Summary has been prepared solely for, and is being delivered on a confidential basis to, persons considering a possible business relationship with the Company (defined herein). This Presentation is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instrument of the Company. Nooffer of securities shall be made except by means of a private placement memorandum meeting the requirements of the Securities Act of 1933, as amended, and applicable regulations of jurisdiction in which such an offer may be made. Any reproduction of this Property Summary, in whole or in part, or the disclosure of its contents, without the prior written consent of the Company, is prohibited. By accepting this Property Summary, each participant agrees: (i) to maintain the confidentiality of all information that is contained in this Property Summary and not already in the public domain and (ii) to use this Property Summary for the sole purpose of evaluating a business relationship with the Company.