Market & Macroeconomic Analysis 1Q25

Market & Macroeconomic Analysis 1Q25

Blog · May 20, 2025

The first quarter of 2025 showed a strong US economy mostly driven by consumer spending but considerably full of uncertainty. This first quarter presented a complex and evolving economic landscape for the United States, particularly influenced by a new administration that was noted by drastically cutting federal spending and making big changes to trade, impacting financial markets significantly. The administration created a lot of uncertainty in the markets, made people expect higher inflation, and led to strong negative responses from other countries.

This Market Outlook 1Q25 U.S. Economy analysis delves into key indicators.

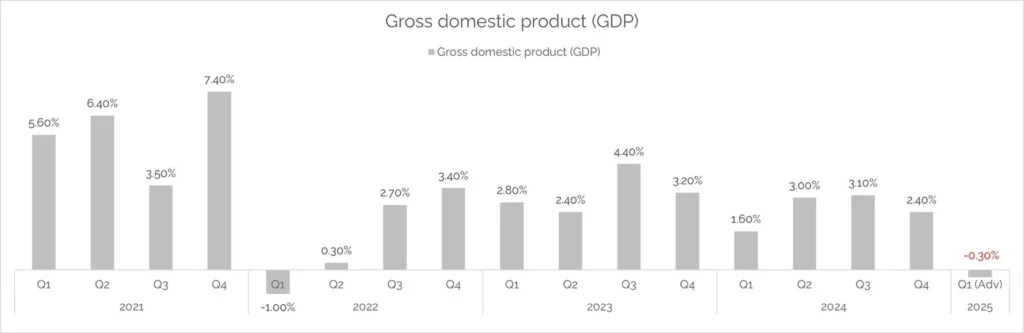

GDP

The Gross Domestic Product, sum of all the goods and services produced, and variable that is taken as the lead indicator of the U.S. economy, contracted at an annualized rate of 0.3% (Advance Estimate) in the first quarter of 2025, marking the first decline since the first quarter of 2022. This estimated contraction might be primarily driven by a surge in imports and a decrease in government spending, which indicated to be partially offset by increases in investment, consumer spending, and exports.

Compared to the previous quarter’s growth of 2.4%, this estimated decline reflects significant economic challenges. Negative GDP growth is rare for the U.S., occurring just three times over the last decade: 2020’s first two quarters as the COVID-19 crushed the global economy, and Q1 2022, when the economy faced rising inflation, leading the Federal Reserve to increase interest rates for the first time in more than three years.

Source: US Bureau of Economic Analysis

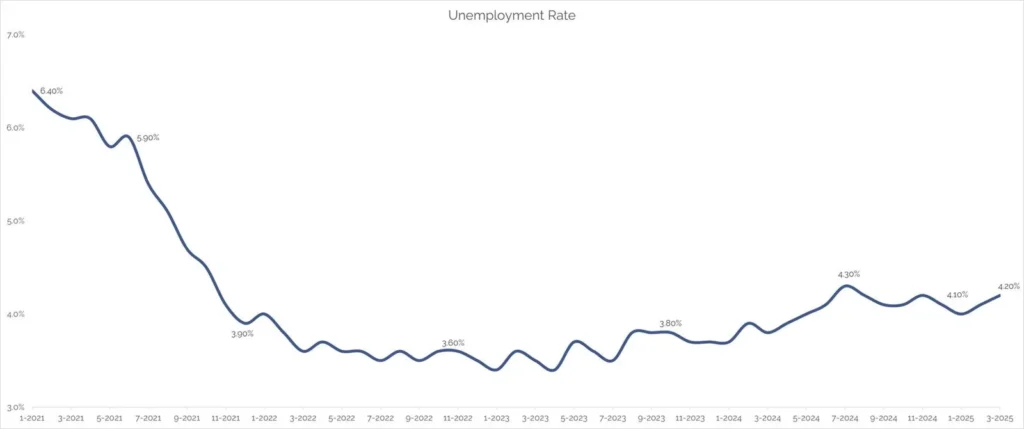

Unemployment

The unemployment rate remained stable at 4.2% in Q1 2025. This rate has fluctuated within a narrow range since mid-2024, indicating a steady labor market. Employment gains were observed in sectors such as healthcare, social assistance, and transportation, while federal government employment declined. The stability in the unemployment rate suggests that the labor market is resilient, although the pace of job creation has slowed compared to previous years.

Source: US Bureau of Labor Statistics

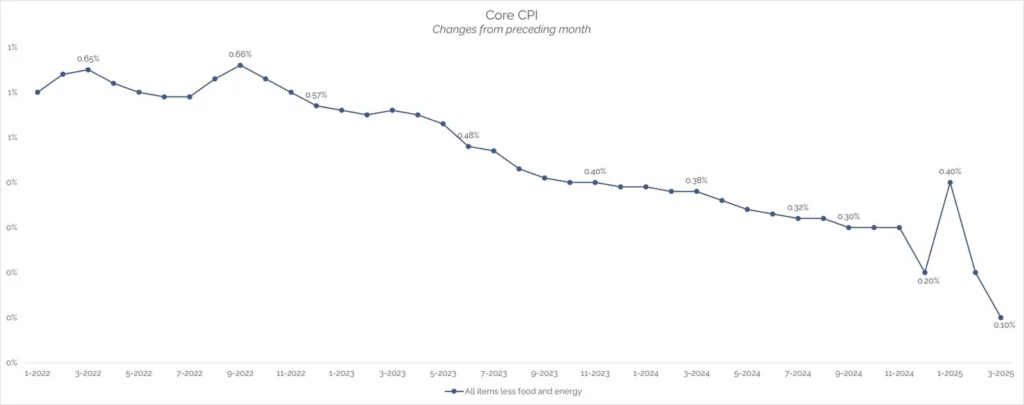

Core CPI

In March, the index for all items excluding food and energy increased by a small 0.1 percent, a slower rate than the 0.2 percent rise in February. Also, Inflation in all items excluding food and energy showed a 2.8% increase over the last 12 months, the slowest yearly growth since March 2021.

Conclusion

The first quarter of 2025 reflected a complex economic environment in the U.S., shaped by a contracting GDP, policy-driven uncertainty, and shifting global dynamics. Despite a resilient labor market and a modest slowdown in inflation, the economy showed early signs of stress—marked notably by a rare GDP contraction of 0.3%. The new administration’s aggressive fiscal cuts and abrupt changes to trade policy introduced increased volatility, impacting both domestic sentiment and international relations. While consumer spending and select sectors like healthcare and transportation provided some stability, the overall outlook remains cautious. Investors and businesses will need to navigate a landscape that demands adaptability, risk awareness, and a keen focus on evolving macroeconomic signals. This Market Outlook 1Q25 U.S. Economy provides crucial insights for navigating these shifts.

As economic signals shift, Apex Development Group remains focused on delivering investment strategies backed by real estate fundamentals, professionalism and experience.