Key Trends to Watch in 2024

Maximize Your Multifamily Investment

As a leading multifamily sponsor, we provide investors with expert guidance and access to exclusive opportunities. By understanding the key trends shaping the market in 2024, we help you navigate the dynamic landscape and maximize your investment potential.

The US multifamily market in 2023 presented a complex picture, marked by both challenges and opportunities. Rising interest rates, property insurance costs, construction expenses, and cap rate compression widened the gap between investors and property owners throughout the year. Looking ahead to 2024, we anticipate a dynamic market with several key trends shaping the landscape:

1. The New Supply Challenge

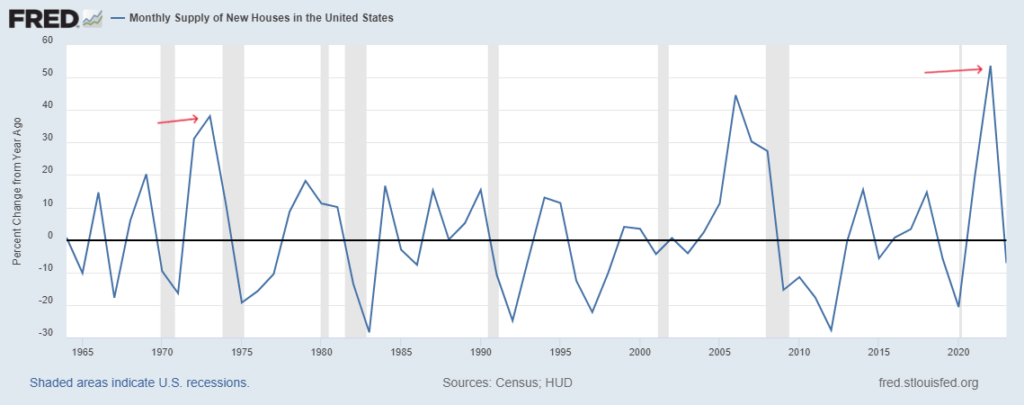

The delivery of over 670,000 new units in 2024 poses a significant challenge that’s hasn’t been seen since 1960-1970s when a significant housing supply impacted the US market. This inflow may trigger tenant migration from Class B and C properties to newer options with better amenities and technology at slightly higher rents. Landlords will need to redefine rent pricing strategies, prioritizing tenant retention over aggressive rent increases.

2. Sustained Demand, Stabilizing Supply:

Despite the new supply, robust demand for housing is expected to persist in 2024, driven by high home prices and limited affordability options. This strong demand should help maintain stable absorption of new units, mitigating concerns about oversupply.

3. Refinancing Wave and Transaction Activity:

Many property owners with short-term, variable-rate loans originated between 2020 and 2022 will seek refinancing options as these loans mature. This, coupled with stabilizing interest rates, is expected to lead to increased transaction volume in the multifamily market.

4. Cap Rate Normalization:

Cap rates, which have been compressed, are starting to stabilize and gradually decompress across the country. Projections suggest they may settle around the mid 5% range in 2024, with a potential further increase to 6% or mid 6%. However, some anticipate compressed cap rates to persist in the first half, particularly for new products in good locations, while old products will tend to have a normal transaction.

5. Market Volatility and Opportunistic Approach:

We expect a volatile market in the early months of 2024, gradually transitioning towards normalization later in the year. Despite the challenges, we remain bullish on the multifamily market. Our approach continues to emphasize thorough underwriting and an opportunistic stance to identify and capitalize on attractive deals.

In conclusion, the US multifamily market in 2024 will be characterized by ongoing adjustments and evolving dynamics. By understanding these trends and adopting a strategic approach, investors can navigate the complexities and unlock opportunities for success. Partnering with an experienced sponsor like Apex can provide invaluable guidance and expertise in navigating the ever-changing multifamily landscape. We turn challenges into opportunities, navigating the complexities and capitalizing on trends explained before requires experience and foresight. Our proven track record and in-depth market knowledge ensure informed decisions. We identify undervalued assets, secure optimal financing solutions, and implement strategic rent pricing strategies to maximize investors’ returns.