Market & Macroeconomic Analysis 4Q24

Market & Macroeconomic Analysis 4Q24

Blog · May 20, 2025

The year 2024 concluded with a robust U.S. economy and initially positive inflation forecasts that later became uncertain. Despite strong U.S. growth, global markets faced challenges such as slowing economic momentum, political conflicts, geopolitical tensions, and currency fluctuations. The Federal Reserve’s controversial “hawkish cut” sparked significant debate, while investors began focusing on the potential impacts of the Trump administration’s policies, introducing considerable uncertainties for 2025.

The last quarter of 2024 indicated a steady economic environment for the United States, particularly following the Federal Reserve’s recent decisions, which always play a crucial role in shaping the economic environment. In this Market Outlook 4Q24 U.S. Economy analysis, we will examine key indicators such as the Core Consumer Price Index (CPI), GDP growth, and unemployment rates.

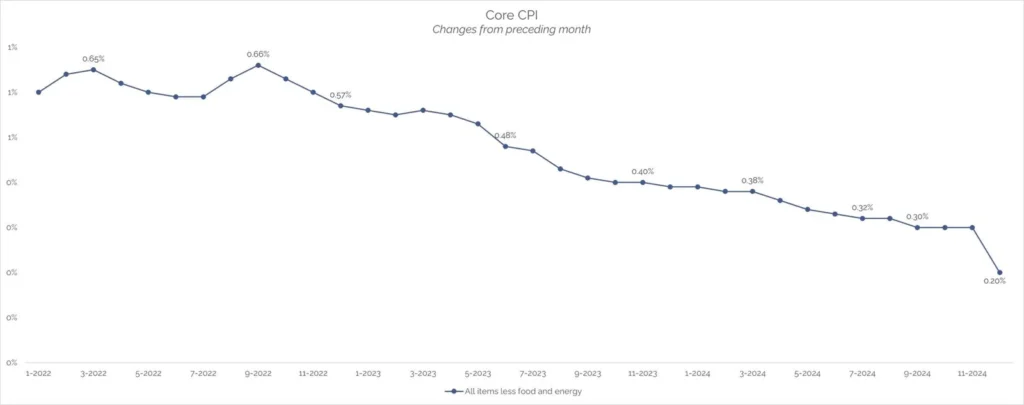

Core CPI

In December 2024, the Consumer Price Index report brought some relief. The Core CPI, a measure that excludes volatile food and energy costs, indicated that price increases were slowing down. It rose by just 0.2% from the previous month, a smaller increase than the 0.3% monthly increases seen in the three months prior. Looking at the bigger picture, the Core CPI was 3.2%, a decrease from the 3.3% year-over-year observed in November 2024. This trend is crucial for policymakers and investors as it impacts purchasing power and interest rate decisions.

GDP

GDP Real gross domestic product (GDP) increased at an annual rate of 2.4% in the fourth quarter of 2024. In the third quarter, real GDP increased 3.1 percent. The increase in real GDP in the fourth quarter primarily reflected increases in consumer spending and government spending that were partly offset by a decrease in investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Source: US Bureau of Economic Analysis

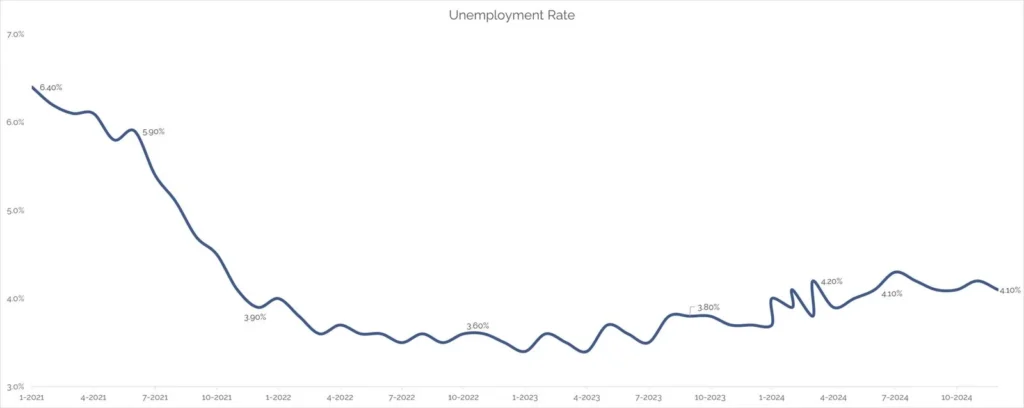

Unemployment

The unemployment rate was 4.2% in the fourth quarter of 2024. This rate reflects a slight increase from previous quarters but remained within a narrow range, indicating a relatively stable labor market. Employment gains were observed in sectors such as healthcare, professional services, and government, while manufacturing and retail experienced slower growth.

The Federal Reserve’s recent rate cuts aim to support economic growth and prevent further job erosion. Monitoring these trends will be essential for understanding the broader economic outlook as we move into 2025.

Source: US Bureau of Labor Statistics

Conclusion

The fourth quarter of 2024 showcased a resilient and dynamic U.S. economy, despite facing several global challenges. Key economic indicators such as GDP growth, Core CPI, and unemployment rates provided a comprehensive view of the economic landscape. This Market Outlook 4Q24 U.S. Economy highlights how the Federal Reserve’s decisions, including the “hawkish cut,” played a crucial role in shaping the economic environment, sparking debate and influencing market dynamics. While the U.S. economy demonstrated strength, global markets contended with slowing momentum, political strife, geopolitical tensions, and currency volatility.