Why is the Fed Raising Interest Rates?

Inflationary Pressures and the Rising Rate Cycle

In 2022, the FED began raising interest rates in response to rising inflation. This rate-hiking cycle has continued into Q3 2023 and is expected to continue at least until the end of 2023. In this article, we will briefly analyze the factors that contributed to inflation reaching its highest level in 40 years and how this led to the current interest rate hike cycle.

Inflation

Inflation is a general increase in prices and a decrease in the purchasing power of money, think of inflation as a generalized increase in prices of goods and services. Inflation can also be a product of scarcity if a product that is in high demand suddenly starts to be unavailable, then the price will rise rapidly. If this product is vital for a sound economy, this scarcity will lead to it.

It can be caused by several factors, including:

- Increased demand: When demand for goods and services exceeds supply, businesses can raise prices.

- Decreased supply: When the supply of goods and services is disrupted, businesses may raise prices to compensate.

- Cost-push inflation: When the cost of producing goods and services increases, businesses may pass on these costs to consumers in the form of higher prices.

The main factor that drives the tendency of interest rates is inflation. In an organized economy, this increase usually follows a long cycle of low interest rates, higher than expected economic growth, and a high volume of money being injected into the economy via investment or government incentives. All the aforementioned factors lead to more money in circulation in the economy. If businesses and homes have more cash in hand, they will increase their demand for services and goods which will lead producers to set their prices higher.

What was the behavior during the past pandemic?

The COVID-19 pandemic caused a sudden halt to business activities in the first half of 2020. Global mandatory quarantines forced all but essential businesses to close, leading to widespread bankruptcies, layoffs, and shortages of several goods and services. As a result, people and businesses clinched to their available cash and significantly decreased their consumption, investments and put a stop on their growth plans. A prolonged decline in goods and services would have put the US economy in a hard place.

To incentivize consumption, the US government created multiple aid programs for businesses and individuals designed to get cash circulating into the economy, including loans with interest rates close to zero, payroll subsidies, tax deductions, and government checks. At the same time, the FED was drastically reducing interest rates until they reached levels that were close to zero. This exponential diminish cycle was later known as “free money”.

After vaccines became widely available and quarantine ended, most of the world quickly returned to normal, businesses reopened, and the panic went away. Nevertheless, the economy was already flooded with cash. After that, the tables turned, and the large amount of cash in circulation led to the highest inflation the US has seen in 40 years.

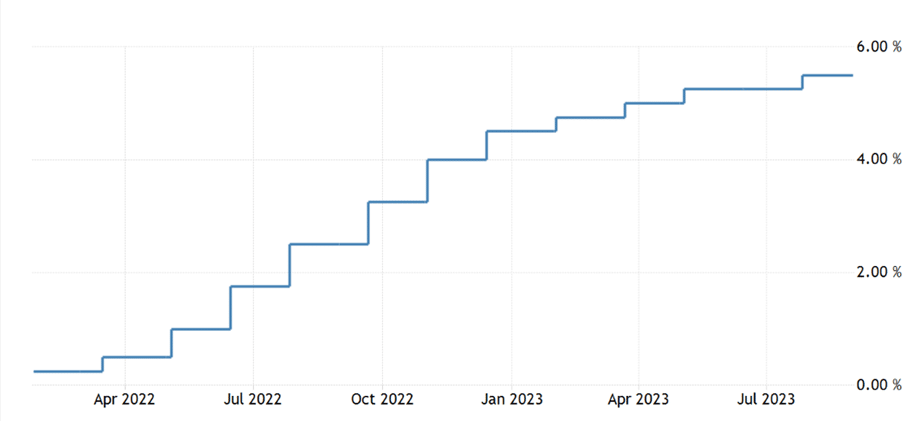

As it is widely known, the FED’s main role is to keep inflation under 2%, and in June 2022 it reached 9.06%. As a result, the goal was to get inflation back to its target level so the way to achieve this was via interest rate. Since then, the Fed initiated a rate hike cycle that is likely to continue as of September 2023. In fact, the Effective Federal Funds rate has gone from 0.25% to 5.25%, the steepest increase since the Volcker Shock in the 1980s.

As of August 2023, data revealed that core inflation sits at 4.35%. Even though it has drastically decreased from 9.06%, it is still more than double the target inflation of 2%. FED’s chair, Jerome Powell, has hinted that the interest rate hike cycle will keep on going until there is convincing evidence that the 2% goal will be achieved. It is important to note that raising interest rates can have a negative impact on the economy. Higher interest rates can make it more expensive for businesses to borrow money and invest, and it can also make it more expensive for consumers to borrow money to buy homes and vehicles. However, the FED believes that raising interest rates is necessary in order to control inflation and protect the long-term health of the US economy.

To summarize, the COVID-19 pandemic had a significant impact on inflation and monetary policy. Government stimulus programs and the Fed’s low interest rates led to a large increase in the money supply. When the pandemic subsided and businesses reopened, this influx of cash fueled a surge in inflation. The Fed is now raising interest rates to bring inflation back down to its target level of 2%.

The Relationship Between Inflation and real estate

The Fed has been raising interest rates aggressively in an effort to bring inflation back to its target level. The Fed has raised interest rates four times in 2023, with the most recent hike being a 25 basis points increase in July. The rising rate cycle is having a significant impact on the real estate market as higher interest rates make it more expensive to borrow money to buy a property. This is leading to a decrease in demand for homes and a slowdown in the housing market with a notorious impact on inventory levels and absorption rates.

The Fed’s rate hikes are also having an impact on home prices. Home prices have been rising rapidly in recent years, but the pace of growth is starting to moderate. This is due, in part, to the higher interest rates, which are making it more expensive for buyers. The real estate market is likely to remain under pressure for the foreseeable future as the Fed continues to raise interest rates. However, the long-term impact of the rising rate cycle on the real estate market is still uncertain.

At Apex, as a real estate investment value-add firm focused on multifamily in metro Atlanta, when interest rates and inflation are high, we keep in mind factor such as:

- Property type: We focus on multifamily properties that have the potential for value-add improvements. This could include properties that need renovations, or repositioning. We believe that a value-add strategy offers the best potential for returns in a high interest rate and inflation environment.

- Location: We are always looking for opportunities in submarkets with strong fundamentals, such as high job growth, low unemployment, and good schools. We also look for properties that are close to amenities and transportation.

- Price: We diligently underwrite properties to make sure we pay a fair price for our properties, even when interest rates and inflation are high. We do this by carefully analyzing the market and by using a variety of valuation techniques.

- Cash flow: We focus on assets that generate positive cash flow. This helps us to weather economic downturns and to generate returns for our investors.

- Borrowing costs: We carefully consider the impact of the borrowing costs on our cash flow and profitability. That is why we have a team of experts that negotiate and assess risk, which is constantly monitoring monetary policy. Also, we engage in rate cap agreements to mitigate the risk of rising interest rates.

- Potential for slower economic growth and higher inflation: We recognize that higher interest rates can lead to slower economic growth, reducing demand for multifamily housing. However, we carefully monitor macroeconomic trends and adjust our investment strategy as needed.

- The exit strategy: This includes understanding when and how we will sell the property to generate a profit for our investors.

By carefully considering all these factors, we can make informed investment decisions that protect our investors’ capital and generate attractive returns even in a high interest rate and inflation environment.