Housing Market Shows Steepest Price Drops Across the U.S.

Housing Market Shows Steepest Price Drops Across the U.S.

Blog · December 08, 2025

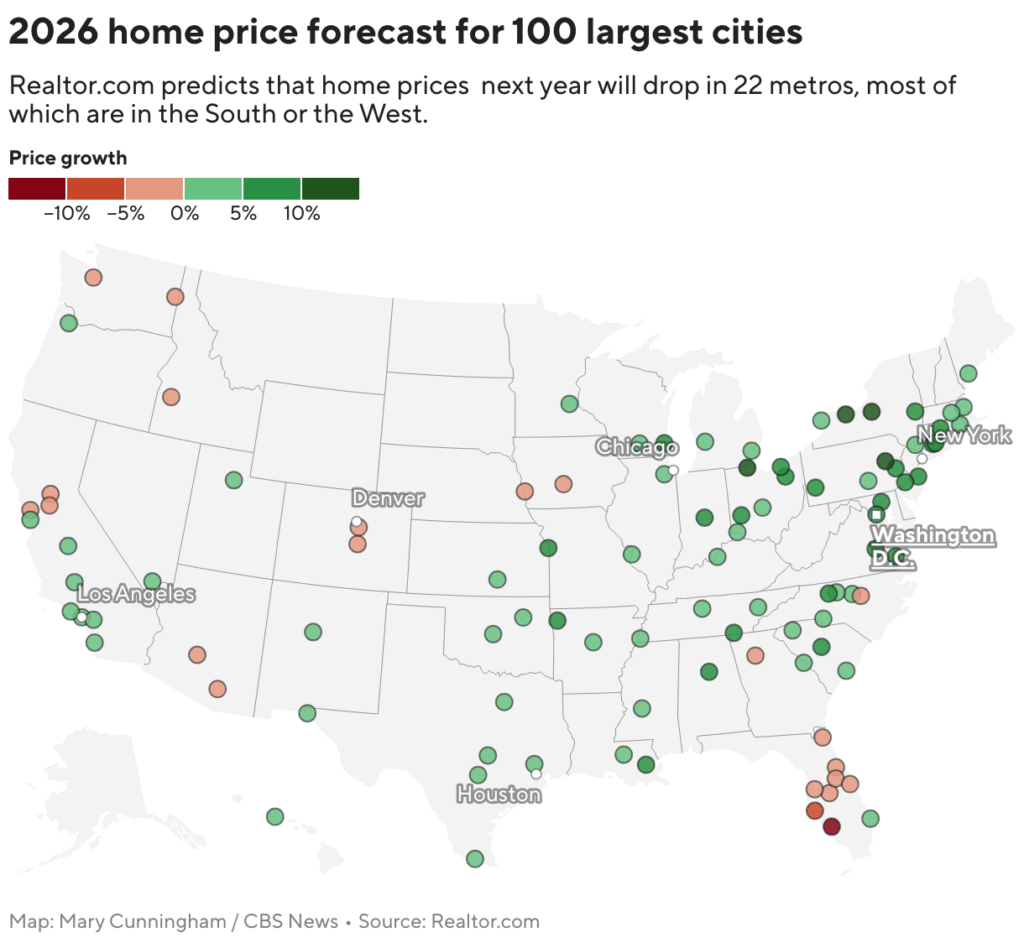

When a new national map shows where U.S. home prices are dropping the fastest, it’s easy to jump to conclusions. But steep declines in a handful of states don’t automatically mean a nationwide downturn. Instead, they highlight a long-standing truth: not all markets behave the same.

Some regions swing sharply when rates rise, while others move gradually, supported by steady demand and diverse local economies.

So when Newsweek published new data showing the states experiencing the steepest price drops, it didn’t signal a collapse; it simply revealed which markets were overheated, overbuilt, or overly dependent on speculative growth.

Why Certain States Drop Faster Than Others

The markets showing the biggest price declines typically share a few traits:

- Rapid pandemic-era price spikes

- Heavy reliance on in-migration

- Faster construction pipelines that can suddenly overshoot demand

- Less diverse job bases

These areas are far more sensitive to interest-rate pressure.

When rates jump, demand cools quickly — and prices adjust just as fast.

When rates jump, demand cools quickly — and prices adjust just as fast.

Meanwhile, more stable, economically balanced markets tend to move differently.

They don’t surge as dramatically in the good years, and they don’t fall as sharply when conditions tighten. Many parts of the Southeast — including select Georgia metros — continue to show this steadier, income-driven behaviour, supported by diverse job sectors and family-anchored rental demand.

Patterns Investors Should Watch

This week’s data reinforces a few clear patterns across the U.S.:

- Volatile markets are unwinding the aggressive gains of the last four years.

- Supply-constrained metros with strong employment hubs continue to hold value.

- Family-driven suburbs remain among the most resilient segments.

- Sun Belt regions are maturing, and performance varies widely from one county to the next.

It’s not about “good” or “bad” states — it’s about understanding how local economic engines, housing supply, and migration trends shape each micro-market.

Housing corrections are not failures; they’re signals.

Price dips often reflect markets returning to sustainable levels after overheating, while stable markets remind us that long-term fundamentals matter more than short-term swings.

For investors, the takeaway is simple:

Focus on regions with durable job growth, healthy rent-to-income ratios, and consistent demand — the places where volatility stays contained and income stays predictable.

The data changes every week, but the fundamentals don’t.